Discover The Best Startups in London

Get the best startup news from London:

Fintern

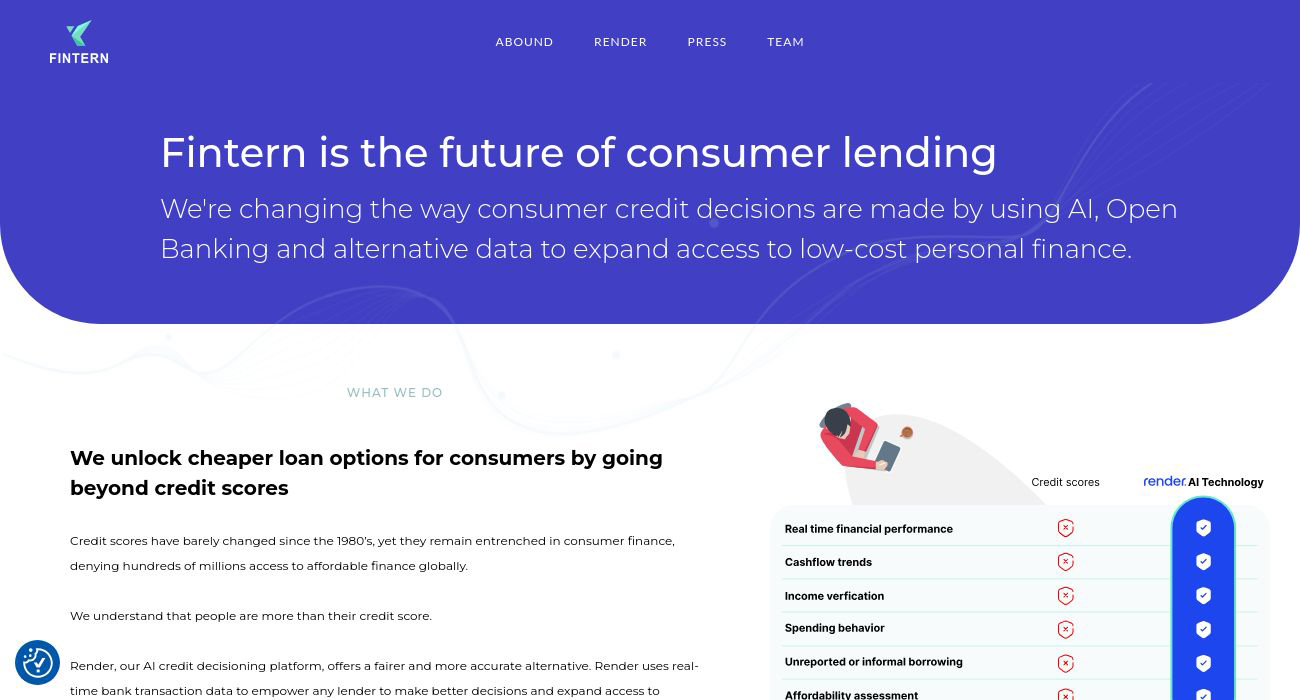

Fintern is a game-changing tech-based financial institution that is revolutionizing consumer lending through its cutting-edge AI technology. Established in 2020, the company pioneers a transformative way of making consumer credit decisions by leveraging AI , Open Banking, and other data sources. With a firm conviction that consumers are more than their credit scores, Fintern provides an alternative credit decision-making platform, Render, that looks deeper into consumers' financial profiles.

The UK-based lending firm operates two major businesses, Abound and Render. Abound, a consumer lender, expands the availability of affordable loans to customers who are traditionally underserved because of their credit scores, providing them with a fair opportunity to avail low-cost personal finance. Rendering its tech-savvy capability, Abound utilizes the AI credit decisioning platform, Render. The Render platform uses real-time bank transaction data, allowing lenders to make comprehensible financial decisions based on the consumers' unique financial situations. This eliminates the dependence on traditional credit scores and has led to a significant 70% reduction in default rates compared to market expectations.

In essence, Fintern, through its divisions Abound and Render, offers a potent combination of advanced technology and financial inclusiveness. The firm has successfully expanded access to low-cost personal finance, making it an attractive choice for consumers seeking affordable loans. Moreover, its unique approach, driven by the use of AI and open banking transaction data, provides a more accurate and fair alternative to traditional credit scores. This positions Fintern as a promising player in the financial landscape, committed to unlocking more cost-effective loan options for consumers, and transforming the way consumer credit decisions are made.